A version for students with low scores includes tuition starting in the second year. The card has a reasonable starting credit limit of $300 to $1,000, and if your credit score is good after six months, you can apply for a credit limit increase. Some of you may receive offers including a 1% cashback bonus. You can use it after receiving an offer in the mail.

You will receive a MasterCard with a credit limit between $300 and $1,000. Use your Verve Card anywhere Mastercard is accepted. You can shop, dine out, and even travel with your new Verve credit card.

“Verve” is just the name of the credit card. Credit cards often bear names after the issuing banks as a marketing tactic to entice people to sign up.

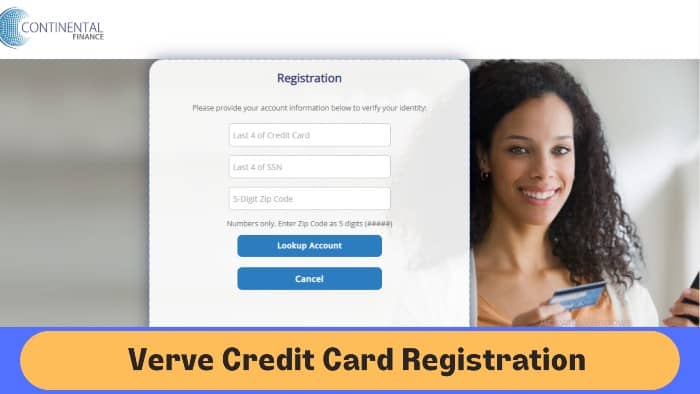

How To Register For Verve Card?

You must carry on for Verve Credit Card registration to receive the login username and password. It may also require other personal information. You must first create a new account at vervecardinfo.com. We provide a complete guide on how to register at VerveCardInfo.com accurately.

- Open the page on your computer or smartphone at www.vervecardinfo.com or wwwyourcreditcardinfo.com.

- Now select “Login” and “Register now” because you are new and need an account.

- Enter the last four digits of your Verve credit card’s SSN in the three empty bars and a five-digit date of birth or zip code.

- Now select “Find an account.” The system will indeed find your account based on the mentioned details.

- You should verify your information and increase the security of your account by setting a username, password, and protection questions on the next screen. Please note that this information is valuable if you want to reset your VerveCard login password.

- Finally, complete the registration process. After a few minutes, you will gain access and be able to log into your Verve Credit Card Info account.

Of course, you will also receive a notification on the screen of your registered mobile number once you have provided all the information. You can currently follow the Verve Credit Card registration process.

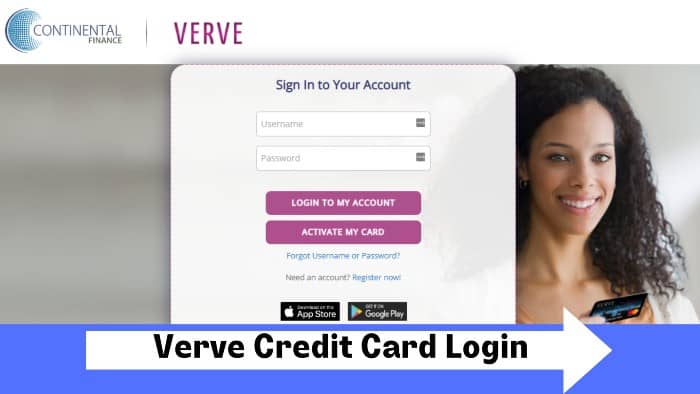

Guide To Verve Credit Card Login

To login with your Verve credit card, follow these steps:

- Visit the Verve Credit Card Online website at www.vervecardinfo.com or wwwyourcreditcardinfo.com.

- Click on the “Login” link in the upper right corner. Your web browser will surely open a new tab as a result.

- The third step involves filling out the empty fields with the password you created when you did your registration and the username you used for login.

- Now you need to select the Login option from the following menu. After that, you will directly access your Verve card information online account. From here, you can manage all aspects of your map.

Which Things Are Necessary For Verve Credit Card Login Procedure?

The following is necessary for the Verve credit card registration process:-

- You can use any browser that works well, like Opera, Microsoft Internet Explorer, Mozilla Firefox, Google Chrome, and Apple Safari.

- You must have your credentials, for example, Your Verve Card login username and password.

- You can perform Verve credit card login tasks through various electronic devices such as P.C., laptops, smartphones, iPad, and tablets.

- Visit www.yourcreditcardinfo.com or www.vervecardinfo.com.

- An excellent internet connection is necessary when performing the Verve credit card login task.

Reset Your Username And Password For Verve Card Login

After the registration process, you will receive your username and password to log into your own Verve Credit Account. A username and password are required for Verve Card Login to pay your bills, view your bank statements, etc. Many users may forget their username or password for Verve credit card login. So for this solution, we will help you reset your Verve credit card credentials.

The steps to reset your Verve Credit Card Login username and password are as follows:

- Visit the website (www.vervecardinfo.com or www.yourcreditcardinfo.com.). The website provided will direct you to the Continental Finance Verve homepage.

- On the website’s home page, click on the “Login” button.

- Upon opening the Continental Finance Verve credit card login page, you will receive a link with the word “Forgot your username or password?” below the login button.

- To reset your username,

- Click on “I forgot my username.”

- Enter the last four digits of your Verve Credit card account number, the last four digits of your Social Security number, and a five-digit zip code.

- Finally, click Find Account.

- To reset your password,

- Click on “I forgot my password.”

- Enter your username and click Submit.

Benefits Of Verve Credit Card

Many cardholders want to know what benefits they will receive after applying for and enrolling in Verve Credit. Many people read Verve credit card reviews and think before applying for the card. Here are the benefits of the Verve credit card:

Have An Unsecured Credit Limit: As part of the bill, you will receive an unsecured credit limit of $750 to pay for your purchases. A $500 credit limit is a relatively high credit limit as most competitors offer a credit limit between $300 and $500.

Potential Credit Limit Increase: Your credit limit on a credit card may increase after six months if you meet specific criteria.

Credit Reporting: Equifax, Experian, and TransUnion have three companies that track your card activity. Maintaining good credit means using your cards responsibly.

Credit Monitoring: Credit scores are available to you every month. You can use this information to track your credit institution’s progress.

No Fraud Liability: The Verve Credit Card has a $0 Fraud Liability. Continental Verve will not hold you responsible if an unauthorized charge appears on your card. They will replace your card quickly and protect you from fraudulent activity.

| Official Site | Verve Credit Card |

|---|---|

| Country | United States Of America |

| Languages Available | English |

| Portal Type | Login |

| Managed By | Continental Finance Company |

Verve Credit Card Payment Options

Pay Online 24/7

Most people go to Continental Finance’s website and sign in to their account.

- Select the “Pay by invoice” option and enter your routing number, bank account number, and the date you want the payment to occur.

- Enter the payment amount and submit your payment.

- This service is available 24 hours a day. Additionally, you can manage your account online, for example, Change your address and personal information and make payments online.

Use A Phone Number

- Dial 1-800.518.6142 to speak with a bank representative.

- After speaking with a staff member, follow the instructions, and you should be able to pay your Verve credit card bill smoothly and as quickly as possible.

- Prepare your account and credit card information before contacting the agent.

Payment By Mail

If you want to send your credit card bill, please use the address below and make your Verve Credit Card Payment to P.O. Box 31292, Tampa, FL 33631-3292.

Customer Service Centres

Continental Finance Company establishes Verve Credit Card Customer Service to resolve inquiries and complaints from Verve customers. Customers can call Verve’s credit card customer service during business hours between 7 am, and 11 pm (Monday-Friday) and 8 am to 8 pm (Saturday-Sunday).

Verve Credit Card customer service representatives are available 24 hours a day, seven days a week. It would be our pleasure to assist you, and we welcome your feedback if you have questions or complaints. After speaking with the agent, you can provide feedback on the type of service received from Verve Credit Card customer service representatives.

Below are the details of the Verve Card customer service phone number:

- Automated Account Information: 1-866-449-4514

- Customer Service: 1-866-449-4514

- Payments: 1-800-518-6142

- Lost/stolen card: 1-800-556-5678

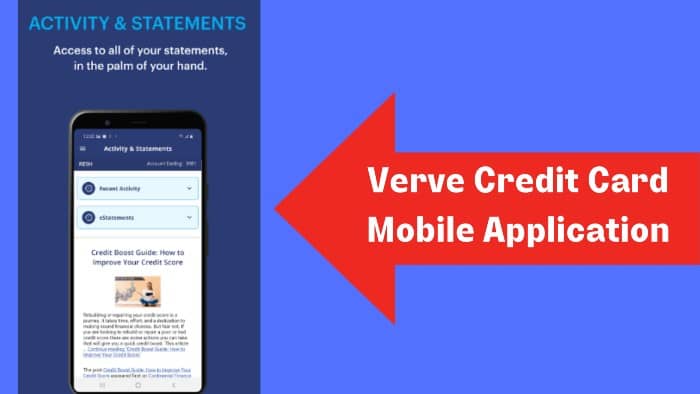

CFC Mobile Access Application For Cardholders

Do you have your smartphones handy? You have heard of various apps available on the Google Play Store. We can carry out financial transactions through our smartphones, for example. Pay your bills, check your bank and credit card balances, transfer your money, open your financial accounts, etc. The Google Play Store generates various financial apps for smartphone users.

Like other financial institutions, Continental Finance Verve offers a mobile app. “CFC Mobile Access” is the name of the application. It is available on the Mac App Store and Google Play Store. Users can download the app through their computer or on their smartphone. Verve Credit users can download and install the CFC Mobile Access app on their mobile devices to use its features.

CFC Mobile Access is a free service for Verve Credit customers with:

-Verve Mastercard®

-The Reflex Mastercard®

-The Surge Mastercard®

-The Fit Mastercard® card

-The Mastercard® matrix

-The Cerulean Mastercard®

-The Build Mastercard®

Features Of The Cfc Mobile Access Mobile App For Verve Credit Cards Include:

The features include:

- Checking your balance.

- Paying bills.

- Sending money to friends and family.

- Transferring money between accounts.

- Making payments and scheduling payments for the future list of recently registered and pending transactions

- Archive all your previous statements

- Account information we maintain for your account with the ability to edit contact information. Did you move to a new location? Here you can update your address.

- You can also call this number in case of loss or theft.

About Continental Finance

A credit card company like Continental Finance Company (“CFC”) is one of the USA’s most reputable credit card companies for consumers with poor credit history. Founded in 2005, CFC Corporation prided itself on corporate responsibility with its three main attributes: a strong support program for its customers, fair treatment, and responsible lending.

CFC has a dedicated team of customer service agents who know the importance of helping customers use credit responsibly. Its goal is to provide all clients with the best possible service, including the training tools needed to manage their loans successfully.

With more than 2.6 million credit cards processed since its inception, Continental Finance Company offers outstanding customer service and access to innovative product features. Unlike traditional credit card issuers, they provide credit products and services to consumers that they do not usually receive. Through a state-of-the-art underwriting, marketing, and consumer services platform, CFC can provide consumers with various services when other financial institutions do not. Whether you have fair credit, bad credit, or limited credit, we can give you access to a product that’s right for you.

Frequently Asked Questions

How Do I Go For Yourvervecard com Application Online?

The steps for Yourvervecard com Application Online are as follows:

- Open your web browser to search https://continentalfinance.net/single_card_info.

- Scroll down to Credit Cards at the top of the Yourvervecard app online portal with

- Click here to find Apply Now.

- Check verve credit cards and order them according to your needs

- Quickly enter information in the columns provided

- Read and accept the General Conditions

- Finally, apply for the Verve credit card using the Apply button.

How To Get A Verve Credit Card Number?

The Verve credit card numbers generated here are 100% valid and follow all formulas to obtain a valid card number. However, details like name, address, expiration date, and security details like CVV have no real value.

To get Verve credit cards, follow the instructions below.

- Click on the Generate button at the top.

- Check the details on the right when changing the values.

- Copy these results.

- Continue clicking the Generate button to generate more Verve Credit Cards.

How Long Does It Take Verve Mastercard To Approve My Application?

In most cases, the decision is immediate. There is a possibility of a 30-day delay in cases where they need more information.

Conclusion

Continental Finance offers Verve credit cards to anyone with a bad credit card history. Anyone can use this card as long as Verve is present. Depending on your credibility, you will benefit from different conditions. You can even get a version with no annual fee if you consider it almost premium.

Many Continental Finance customers have the strategy to read the Verve Credit Card Reviews before applying for the Verve Credit Card. The Verve credit card can be partially secured, fully secure, or completely unsecured, depending on your creditworthiness. Verve customers can pay their credit card bills in a variety of ways.